Did you know businesses lose about $60 billion a year to preventable payment fraud? This…

What is Bankcard MTOT Disc?

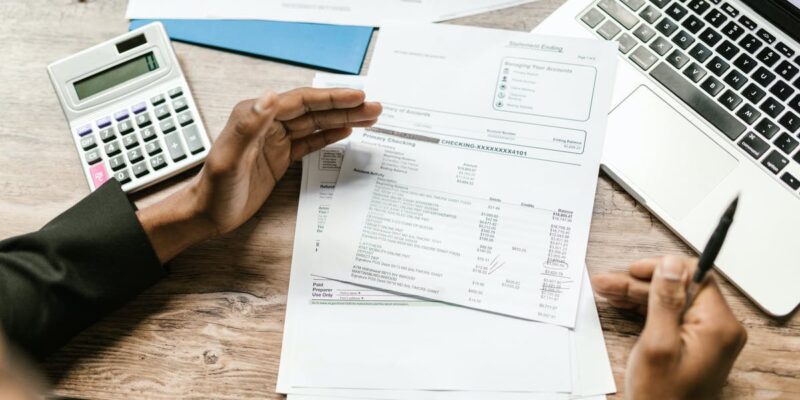

Did you know businesses pay monthly just for card payments through FISERV or First Data? Your bank statement might show “MTOT Disc,” a term many don’t get. It’s not a discount, but the “Merchant Total Discount.” It’s a key part of your finances. So, what does this mean on your bank statement, and how does it affect your costs?

Key Takeaways of Merchant Total Discount

- MTOT Disc stands for Merchant Total Discount Fee.

- It represents monthly payment processing fees.

- This fee is part of the FISERV/First Data network services.

- It includes various charges such as monthly, annual, and transactional fees.

- Despite the term “Disc,” it is not a merchant discount.

- Understanding this fee is crucial for managing your business finances.

Understanding Merchant Total Discount

In this section, we’ll explore the MTOT Disc you see in your banking statements. It’s key to know what it is, why it’s there, and clear up any confusion.

Definition of Merchant Total Discount

“MTOT Disc” means “Merchant Total Discount.” It shows up on your bank statement, showing the fees for handling credit card payments. Understanding this helps you manage your business’s money better.

Why You See MTOT Disc on Your Statement

When you see this on your statement, it means you’re paying a monthly fee to your payment processor. These fees are common and help keep your business’s transactions smooth.

Common Misconceptions

Many think MTOT Disc is a sneaky fee. But it’s a standard charge that changes based on how much you use it and your deal with your processor. Checking all of your charges regularly can help you make sure they’re fair.

How MTOT Disc Impacts Your Finances

It’s important to understand how the MTOT Disc affects your money, as this knowledge is key for planning your budget and managing costs. Specifically, these fees mainly impact your business through monthly costs associated with handling credit and debit card transactions. Therefore, being aware of these fees helps you stay on top of your financial management.

MTOT Disc Charges and Your Monthly Processing Fees

MTOT Disc charges include different fees that add up to your monthly costs. Specifically, these fees cover things like authorizing transactions and processing them. The amount you pay can vary from $40 to $150 each month, depending on how many transactions you have.

Therefore, keeping an eye on these fees is crucial. By doing so, you can better understand how your account works and manage your money more effectively.

Breaking Down the MTOT Disc Charge

To manage your money well, you need to know what the MTOT Disc charge includes. For starters, your monthly statement should show all the fees, such as PCI compliance and statement fees. Additionally, there might also be an annual fee.

This clear information is, in fact, a key feature of this charge. It helps you see the full financial effect on your business. By comparing the fees to your total sales, you might be surprised at how they add up. Therefore, if you want to cut down on these costs, knowing these details is essential.

Conclusion

Understanding the MTOT Disc, or merchant total discount, is key for merchants who take credit card payments. This fee, set by payment processors, can affect your financial plans and profits. Knowing how the MTOT dep fees show up on your statements helps you manage these costs better.

It’s important to check your account statements for the bankcard MTOT dep and any errors. Talking to your payment processors about fee details and looking for ways to save can make a big difference. This keeps your business competitive and financially healthy.

To sum up, knowing how to handle the MTOT disc for sale can lessen its effect on your business’s profits. Keeping up with financial knowledge and managing your finances well can boost your earnings and efficiency. As a merchant, being informed about these fees helps you navigate your finances better.

Contact IntegralPay and we’ll be happy to review your merchant statements and see where you’re overpaying for your merchant services and what we can do to help!

Comments (0)