Did you know that nearly 1% of all credit card transactions lead to chargebacks? For…

Merchant Cash Advance: Quick Funding for Businesses

Did you know nearly 29% of small businesses struggle to get traditional loans? A merchant cash advance (MCA) is a fast solution. It provides quick loans to keep your business going. This alternative funding is great for urgent needs like covering cash-flow gaps or short-term costs.

A merchant cash advance is different from a regular loan. It’s based on future sales, paid back through daily or weekly deductions. It’s faster and easier to get than traditional loans. But, it comes with high annual percentage rates (APRs). These rates can lead to expensive debt if not handled carefully.

Key Takeaways

- Merchant cash advances provide quick funding options for businesses facing immediate cash-flow issues.

- MCAs are repaid through a percentage of future credit and debit card sales.

- This alternative financing method has less stringent approval requirements compared to traditional loans.

- High annual percentage rates (APRs) can lead to expensive debt if not managed carefully.

- Business owners should carefully consider all business loan options due to potential predatory lending practices in the MCA market.

What is a Merchant Cash Advance?

A merchant cash advance is a special kind of financing for businesses needing quick cash. It’s great for those who can’t get traditional small business loans easily.

Definition and Origin

The idea of merchant cash advances started in the early 2000s. Barbara Johnson co-founded AdvanceMe, the first to offer it. It gives businesses upfront money, paid back through a share of future sales and a fee.

This way, businesses get the cash they need fast, without the long waits of traditional loans.

How Merchant Cash Advances Work

Merchant cash advances give businesses quick access to working capital. They repay through a share of future sales, or fixed bank account withdrawals. The fee, or factor rate, is between 1.1 and 1.5, showing the cost of borrowing.

Key Features

Merchant cash advances stand out from other loans. They don’t have fixed repayment terms, so payments change with sales. This makes repayment flexible.

The approval process is fast, often in hours. This makes it perfect for urgent financial needs. Also, the requirements are less strict than traditional loans, helping more businesses qualify.

Since repayments are based on sales, it helps manage cash flow. It adjusts to the ups and downs of business income.

Pros and Cons of Merchant Cash Advances

Looking into the good and bad of merchant cash advances helps you decide if it’s right for your business. Knowing both sides lets you balance the benefits against the possible downsides.

Advantages

One big plus of business cash advance loans is getting money fast, often in a day. This is key for businesses needing cash right away. Also, these loans are good for businesses with credit issues, as many providers don’t just look at credit scores.

Another big plus is not needing physical collateral. This lowers the risk for businesses without big assets. The flexible repayment terms are also a big plus. You pay more when you make more money and less when you make less. This helps manage cash flow better.

Disadvantages

But, merchant cash advances have downsides too. They can be very expensive, with APRs up to 350%. This high cost can hurt a business’s long-term finances. The repayment demands can also be tough, especially when money is tight.

Another issue is that paying back early doesn’t save you money, because the fees are fixed. The contracts can be complex, sometimes hiding important details like APRs. This can lead to surprises and extra costs. Without federal rules, businesses might face unfair terms. And, defaulting on an MCA can have serious consequences, like losing your right to defend yourself in court.

Comparing Merchant Cash Advance to Traditional Loans

Choosing between a Merchant Cash Advance (MCA) and traditional loans requires careful thought. Each option has its own approval process, repayment terms, and costs. Knowing these details helps you make a smart choice.

Approval Rates and Requirements

MCAs are known for their high approval rates. They focus on your sales history, not credit scores. This makes them great for businesses that can’t get traditional loans, which often need collateral or good credit.

Repayment Terms

Repayment terms vary between MCAs and traditional loans. MCAs have short-term, sales-based payments that change with your sales. Traditional loans offer fixed payments over longer times, making budgeting easier.

Costs and Fees

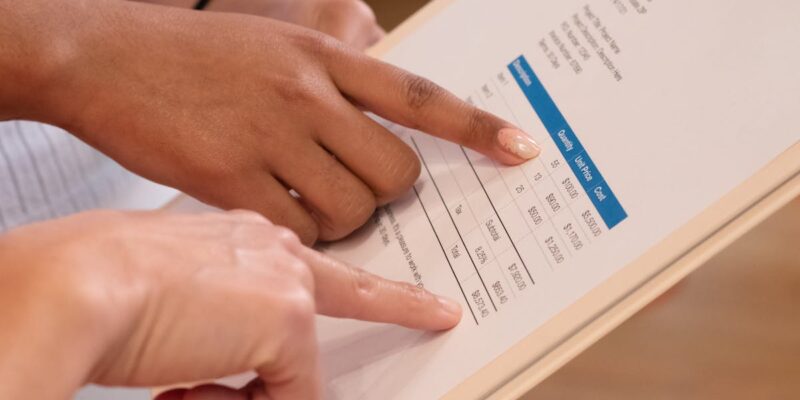

MCAs usually have higher costs because of factor rates. This can lead to very high interest rates. Traditional loans, however, have lower APRs, making them cheaper in the long run. Think about these costs when deciding between an MCA and a traditional loan.

Conclusion

Merchant cash advances are a quick way for businesses to get the money they need fast. They have easy approval and flexible repayment plans that match your sales. This makes MCAs a good choice for businesses looking for quick funding.

But, it’s important to know the high costs of business cash advance loans. The high factor rates and fees can lead to a lot of debt. Even though MCAs offer quick help, the cost is high, so think about the long-term effects.

Traditional small business loans are harder to get but are more affordable. They have lower interest rates and longer repayment plans, helping your business grow. While MCAs are a lifeline for businesses, it’s key to look at all your options. Making a smart choice that fits your business goals is important for lasting success.

Comments (0)