Chargeback Prevention

Reduce credit card returns in your business with our solutions. By using IntegralPay’s Chargeback Prevention program, merchants can avoid as many chargebacks as possible, through a simple onboarding process, on-access alerts, and quick responses from our team of professionals.

✔ Start seeing results in less than 24 hours ✔ Keep merchant accounts healthy ✔ Avoid up to 80% of chargebacks

Wide Range of Services

We provide a wide range of services including but not limited to:

We partner with authorized resellers of Ethoca and Verifi

Learn what makes us stand out!

Our dedicated team of trained professionals will work with you and your business to ensure a reduction in chargebacks. Here at IntegralPay, we want you to have the best ROI possible, which means we help you fight chargebacks with the highest precision and the highest probability of success.

✔ Unmatched customer service

✔ All in one solution

✔ Simple and efficient integration

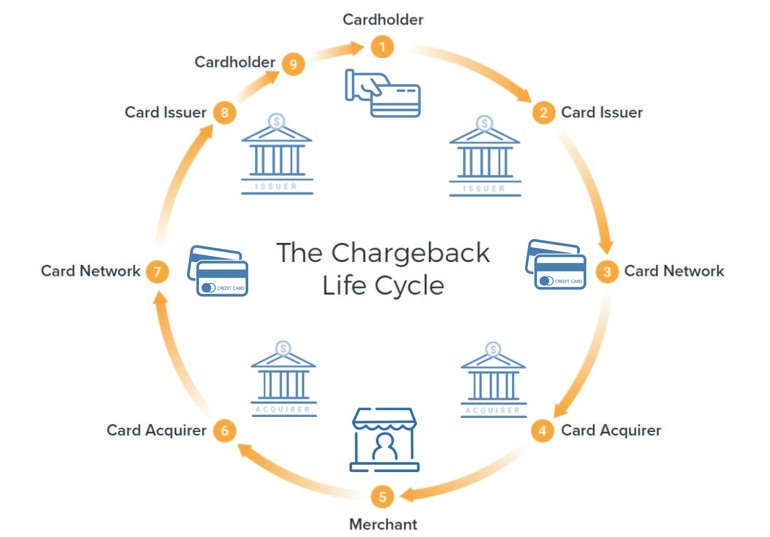

The Chargeback Process: Step By Step

- The cardholder disputes a transaction by talking with the card-issuing bank seeking a refund (providing a reason for request).

- The card issuer then reviews the eligibility of the transaction and if it is legitimate, the card issuer charges back the transaction to the merchant’s acquiring bank through a relevant card association such as Visa or MasterCard.

- The card network then screens the chargeback electronically for technical criteria compliance. If it is confirmed, they forward the chargeback to the merchant’s acquiring bank.

- The acquiring bank may either transfer the money immediately from the merchant’s account to the cardholder, or present the request to the merchant first.

- The merchant receives the chargeback notification and can dispute the chargeback to its acquiring bank.

- The acquirer forwards the merchant’s representment to the card association.

- The card network then forwards the represented item to the card issuer.

- The card issuing bank then reviews the case and if the merchant’s case is compelling, they charge the cardholder’s account again for the disputed transaction. However, if the issuing bank deems that the chargeback issue is inappropriately addressed by the merchant’s representation, it may submit a dispute to the card association which triggers arbitration.

Start Today!