Did you know over 70% of small businesses face cash flow problems? These issues can…

Delayed Capture Payments: A Guide to Secure Transactions

Did you know that 82% of businesses that use delayed capture payments see fewer chargebacks? This shows how helpful this technique is. It lets sellers approve payments but wait to actually charge a customer’s card. Using this method can make your online transactions safer, lower fraud risk, and help manage your money better.

With delayed capture payments, charges are only finished after the items ship or services are done. This adds a layer of security for your customers. As online shopping grows, knowing and using this method can make your business stand out. It can make things more efficient and save you money on processing fees.

Your business, whether in travel, retail, or elsewhere, can benefit. Delayed capture payments protect you, please your customers, and make financial tasks smoother.

Key Takeaways

- 82% of businesses using this see reduced chargebacks.

- Delayed capture validates funds but delays the actual charge until the product is shipped or the service is fulfilled.

- This payment processing method enhances secure online transactions and prevents fraud.

- Implementing delayed capture payments can lead to significant savings on payment processing fees.

- Industries such as travel and retail benefit substantially from delayed capture payments.

Understanding Delayed Capture Payments and Their Benefits

Delayed capture payments give both sellers and buyers a new way to make transactions. They make dealing with money more secure and fast. This method is great because it offers better fraud protection and helps in managing money better.

What is Delayed Capture?

Imagine a payment method that doesn’t take the money off your card right away. It lets sellers check if the deal is real first. This wait is usually a week for debit cards and up to 28 days for credit cards. Sellers can then make sure everything is okay before they accept the payment.

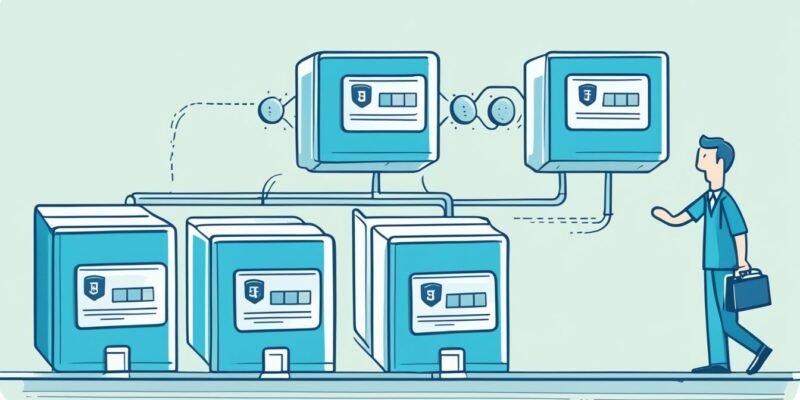

How Does Delayed Capture Work?

Here’s how it starts. You decide to buy something and the seller gets the okay from your card company to take the money. But, they don’t take it all yet. This waiting time is a safety net. It stops mistakes and lets the seller trust the payment.

Why Use Delayed Capture?

Delayed capture fights fraud and makes canceling purchases easy. This means buyers and sellers feel more secure. Buyers know they won’t pay until they should. Sellers see fewer orders canceled or argued about.

Examples and Applications of Delayed Capture Payments

Delayed capture payments offer flexibility used across many fields. This method helps prevent chargebacks and fights fraud. It also helps keep inventory in check, benefiting a company’s finances and operations.

Delayed capture in the Travel Industry

Hotels use this method often. They pre-authorize a guest’s stay cost but take the payment later. This keeps reservations and payments secure. It lowers the risk of guests not showing up but still expects payment.

It also makes payments smoother. This improves the experience for travelers.

Collecting Upon Fulfillment

In the business world, delayed transactions are key for manufacturers and sellers. They wait to capture payments until the order is complete. This ensures the product is there before they charge. It helps manage inventory and makes customers happy.

This also smooths out payment delays. It builds trust between businesses and their customers.

Delayed Capture at Gas Stations

At gas stations, delayed capture is important too. They pre-authorize a limit for fuel, then capture the real cost later. This makes buying gas easy for customers. It also helps manage fraud and keeps billing correct.

Conclusion

Delayed capture payments are a big step forward in how payments are made. They make transactions safer for both sellers and buyers. With these payment methods, businesses can review each sale, keep better track of their products, and dodge early chargebacks. This boosts the whole payment process, making sure transactions run smoothly and safely.

This way of accepting payments also benefits the customers. It works well in any industry, from travel to shopping, or even at gas stations. Businesses can accept and process payments securely. It offers the best of both worlds, letting customers pay with ease and keeping transactions safe.

As tech gets better, it’s clear that using delayed capture payments can really help your business. It’s a strong mix of safety and convenience. This makes delayed payments key to running your business well and keeping transactions dependable.

Source Links

- What is delayed capture for payments? | Checkout.com – https://www.checkout.com/blog/delayed-capture-payments

- Delayed Capture — What You Need to Know | Shift4 – https://www.shift4.com/blog/delayed-capture-what-you-need-to-know

Comments (0)