Did you know the IPTV market is set to hit $104 billion by 2023? This…

The Do’s and Don’ts of Processing History

If you’ve ever applied for a merchant account you may have been asked to provide credit card processing history. Acquiring banks ask for processing history to get an idea of how your e-commerce business has performed recently, in terms of credit card sales volume, refunds, and chargebacks.

Acquiring banks use this information to evaluate whether they will approve or deny an application, and if approved, what the terms are going to be. For example, high chargebacks may mean that a higher rolling reserve would be required, or that you sign up for chargeback mitigation services (we can work on drastically reducing your Visa chargebacks – before they happen! – with our Visa Merchant Purchase Inquiry program)

What if you don’t have processing history? No problem, you can also get a startup merchant account through us.

As you use your merchant account, be sure to file away your processing history just like you would your regular accounting (bank statements and invoices). Think of processing history as part of your business’s assets!

What Makes Up Processing History?

– Processing Statements. Ideally, your merchant account provider will send you monthly statements in PDF format, showing that month’s total of sales volume, refunds and chargebacks. However, not all merchant accounts are created equal. For example, you may get statements weekly, or they do not include chargeback details.

– Screenshots of Merchant Admin Area Reports. Most merchant accounts provide you with a login to view your transactions and reports. Be sure to take screenshots of the reports that make it clear how your merchant account is performing EACH month.

What Acquiring Banks Want

Acquiring banks want to see individual month statements or reports, such as monthly statements showing summary totals of sales volume, refunds, and chargebacks, typically for the past 3 or 6 months.

They want to see them as either PDF statements direct from your merchant account provider, scanned paper statements, or screenshots of your merchant admin area.

SHOW them, don’t TELL them.

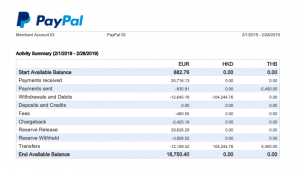

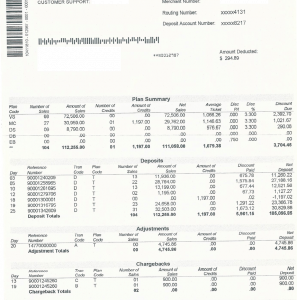

Examples of good processing history statements, showing a single month’s activity: sales, refunds, and chargebacks.

What Acquiring Banks Do NOT Want

- An exhaustive list of transactions, especially with totals at the bottom. This information is not useful for approving a merchant account.

- OLD processing history. Typically, US banks need the past 3 months processing history, and EU and offshore banks the past 6 months. If you have started up more recently, provide what you have since the start. What you did 2 years ago is irrelevant for most merchant account applications.

- Unexplained gaps in processing history. If you had a merchant account recently and it was closed, and you haven’t been processing for a few months, we can still work with that — but the gap in processing needs to be explained ahead of time.

- Excel, CSV, or any other form of editable soft copy is useless to the acquiring bank.

- Processing statements or report screenshots that do NOT show the merchant’s company or website name on it.

- Processing statements or report screenshots covering multiple months, that do not show stats for each individual month. For example, if your merchant admin area provides reports for January to March, please provide separate screenshots of the January, February, and March reports — NOT the January 1 to March 31 all at once.

SHOW them, don’t TELL them.

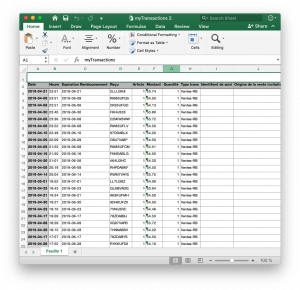

Example of bad processing history: a list of transactions in Microsoft Excel format. This is NOT useful to the acquiring bank.

At IntegralPay, we’ll assist you in making sure your processing history is of the format that acquirers are looking for, avoiding delays in the approval process.

Get started with our pre-qualification form now, or contact us now for further information.

Comments (0)